When you start thinking about arranging care for a loved one at home, one of the first and most significant questions is always about the cost. It’s a completely natural concern, and getting a handle on the numbers is the best place to start.

Generally speaking, you’re looking at an hourly rate of between £25 and £35 for standard in-home care here in the UK. For more intensive, round-the-clock support, live-in care can often start from £1,200 per week.

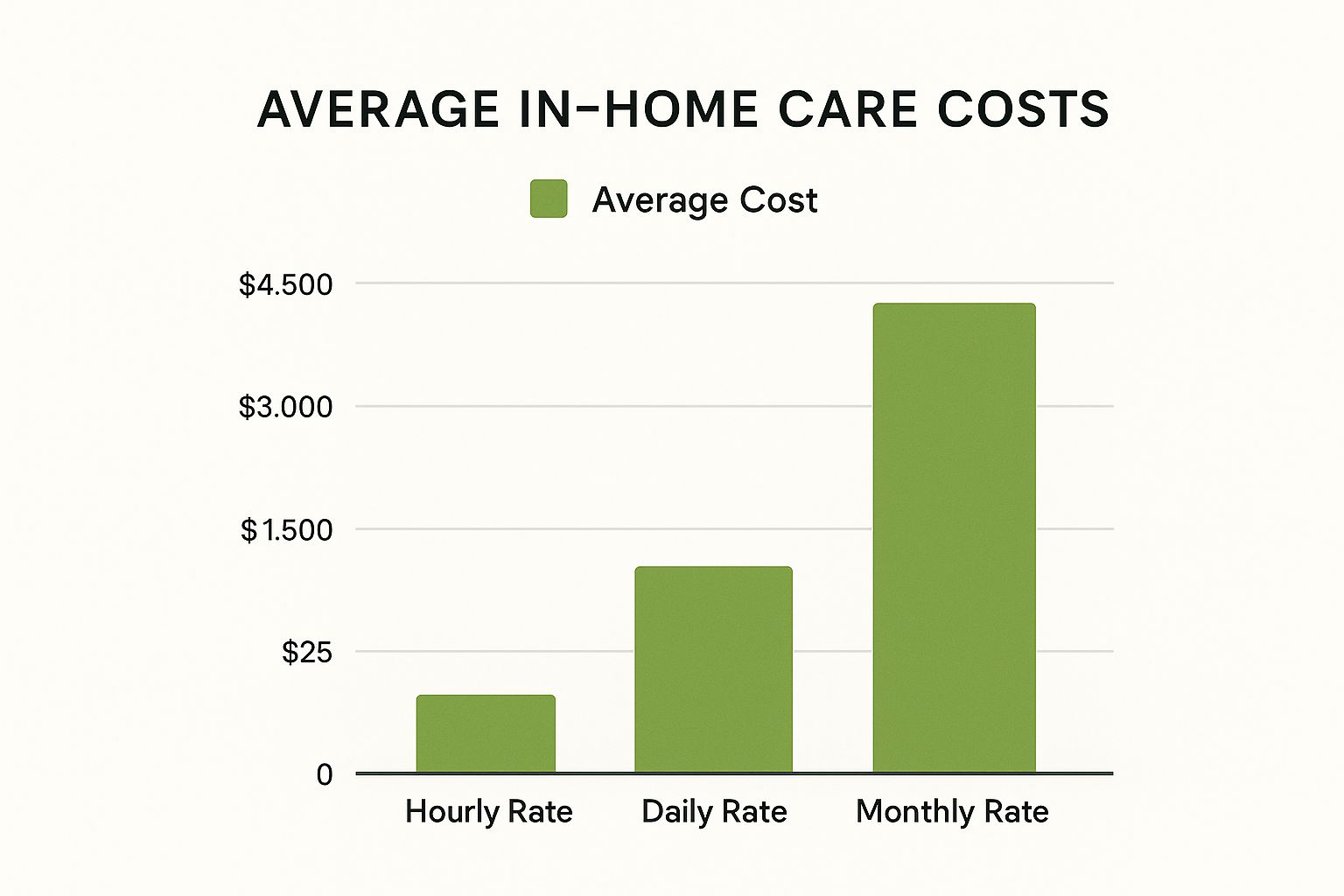

A Quick Look at In-Home Care Costs

So, how much does in home care cost in reality? The truth is, there's no single, one-size-fits-all answer. The final figure depends entirely on the level of support your loved one needs. It could be anything from a friendly face popping in for a couple of hours a week for a chat and a cup of tea, right through to complex, 24-hour medical assistance.

Think of it as a spectrum of care, where each level of support has its own associated cost. This overview will give you a ballpark idea of the finances involved, helping you plan with confidence.

Breaking Down the Average Costs

Let's get into the specifics. As of 2025, the costs for different types of care generally fall into these brackets:

- Hourly Care: Most families start here. For help with personal care, daily tasks, and companionship, the average is £25 to £35 per hour.

- Overnight Care: For peace of mind through the night, costs typically sit between £130 and £160 per night.

- Live-in Care: For continuous, 24-hour support, expect to see weekly costs ranging from £1,200 to £1,800, depending on the complexity of the care required.

To give you a clearer picture, here’s a breakdown of how those costs compare.

As you can see, the investment grows with the level of need, moving from a manageable hourly rate to a more substantial weekly cost for full-time care. If you're looking for a comprehensive breakdown, this guide on finding carers for elderly loved ones, including their associated costs is a fantastic resource.

What Do These Figures Include?

It's a fair question: what do you actually get for that hourly or weekly rate? While every care plan is unique, most standard packages are built around a core set of services designed to make daily life safer and more comfortable.

Here’s a summary of the typical costs you can expect to see across the UK for different in-home care services.

Typical In-Home Care Costs in the UK

| Type of Care | Average Cost Per Hour/Night/Week |

|---|---|

| Hourly Care | £25 – £35 per hour |

| Overnight Care | £130 – £160 per night |

| Live-in Care | £1,200 – £1,800 per week |

These figures provide a solid baseline, but always remember that they can vary based on your specific location and the level of expertise required from the carer.

Generally, these costs cover the essentials that help people live well at home:

- Personal Care: Dignified help with daily routines like bathing, dressing, and getting around safely.

- Companionship: Much more than just a presence, this includes social interaction, trips to appointments, and sharing in hobbies.

- Household Help: Keeping on top of things with light housekeeping, preparing nutritious meals, and running errands like shopping.

- Medication Reminders: A simple but vital service to ensure medication is taken correctly and on schedule.

To get a feel for how these services come together in a real-world care plan, you can explore our detailed guide on what home care involves. This will give you a much clearer idea of what to expect. Just keep in mind that any specialised medical needs will naturally adjust the final cost.

What Really Drives Your Final Care Bill

While it’s tempting to look at national averages to get a ballpark figure, they rarely paint the full picture of how much in-home care will cost for your family. The truth is, the final number on your bill is shaped by a unique mix of personal needs and practical circumstances. It’s why two families, both receiving care for the same number of hours, can end up with vastly different invoices.

The biggest single factor is the level of care required. A simple weekly visit for a bit of companionship and some light housekeeping will, quite naturally, sit at the lower end of the price scale. However, if a loved one needs more hands-on support for a condition like dementia, or requires help with mobility and personal hygiene, the cost climbs to reflect the carer’s specialist skills and greater responsibilities.

The Impact of Needs and Location

It’s crucial to get your head around the different types of care. There’s a world of difference between general home help and dedicated personal support, for instance. Our guide exploring personal care vs home help breaks this down in detail, helping you make sure you’re only paying for the exact level of support that’s needed.

Your postcode also has a major say in the final cost. Care rates are far from uniform across the UK. You’ll almost always find that prices in London and the South East are significantly higher than in places like Stoke-on-Trent or Newcastle-under-Lyme. This all comes down to local living costs, carer wages, and the demand for services in the area.

Your final care bill is a direct reflection of the support’s complexity and intensity. It’s less about the clock and more about the specific skills and attention required during each visit.

Agency vs Private and Other Cost Factors

How you arrange the care also makes a big difference to your budget. Going through a regulated care agency often means a higher hourly rate, but that extra cost covers some really important things. It pays for rigorous background checks, comprehensive insurance, continuous training for carers, and fully managed payroll. It’s the price of complete peace of mind.

On the flip side, hiring a private carer directly might look cheaper on paper, but it means you become the employer. That puts you on the hook for handling contracts, insurance, taxes, and finding cover when your carer is on holiday or off sick.

A few other things can nudge the costs up or down:

- Carer Experience: Carers with years of experience or specialist qualifications in areas like palliative or dementia care will rightly command a higher rate.

- Unsociable Hours: You should always expect to pay a premium for care delivered in the evenings, over the weekend, and especially on bank holidays.

- Travel Costs: Some agencies might add a charge for a carer's travel time or mileage, which is more common in rural areas.

Getting to grips with these financial details is key. The processes behind healthcare revenue cycle optimisation show just how many moving parts contribute to the final cost. By asking providers the right questions about these factors upfront, you can build a much clearer and more predictable budget from the start.

Getting to Grips with the Official Minimum Price for Homecare

When you first start looking at quotes from different care providers, the numbers can be a bit bewildering. To really make sense of them, it helps to know about the industry's official benchmark for fair pricing. This baseline exists for a good reason: it ensures care agencies can run a stable business while giving your family the high-quality, dependable support you need.

This benchmark is called the Minimum Price for Homecare, and it's set by the Homecare Association. It's not just a number plucked out of the air. It’s a carefully worked-out rate that covers the true cost of providing professional, safe, and legal care here in the UK. You can think of it as a quality watermark—a price that lets agencies pay their skilled carers properly, cover all the essential running costs, and still have enough to invest in getting better.

What’s Actually Included in the Minimum Price?

The Minimum Price for Homecare is built on several costs that every reputable agency has to cover to operate legally and ethically. It’s about much more than just the carer’s hourly pay.

The calculation factors in several key things:

- The National Living Wage: This is the legal minimum salary for carers and the biggest part of the cost.

- Carer Travel Time: Carers have to be paid for the time it takes them to get from one client's home to the next. It’s a crucial cost that often gets forgotten.

- Employer National Insurance & Pension Contributions: Like any good employer, agencies have legal duties to contribute to their team's financial security.

- Essential Running Costs: This is the catch-all for everything from staff training and DBS checks to insurance, protective equipment (PPE), and office admin.

Once you see all these moving parts, it becomes much clearer why quality care comes with a certain price tag. It also helps explain the gap you might see between a quote from a fully regulated agency and a private arrangement.

The Official Rate for Sustainable Care

So, what’s the magic number? For 2025/26, the Homecare Association has set its recommended Minimum Price for Homecare in England at £32.14 per hour. This figure has been updated to reflect recent legal changes, including a 6.7% jump in the National Living Wage and higher employer National Insurance contributions. You can dive into the full breakdown and learn more about the industry’s minimum price recommendations on their website.

This official minimum isn't about maximising profits; it's about sustainability. It's the lowest possible rate an agency can charge while still meeting its legal and ethical duties to its clients and its carers.

When you see an agency charging at or above this rate, it's a really positive sign. It tells you they’re serious about fair pay and high standards. This is so important because fair pricing helps keep skilled, compassionate carers in the job, which prevents high staff turnover and leads to more consistent, reliable support for your loved one. It’s a vital piece of the puzzle to consider when you’re figuring out how much in home care cost quotes truly reflect quality.

Finding Financial Help for Home Care Costs

Seeing the potential costs of care laid out can feel pretty daunting. But it's so important to remember that you don't have to face them alone. There are several different routes to getting financial support here in the UK, all designed to help families manage the expense of professional care at home.

The trick is knowing where to look and how to get the ball rolling. For most people, that journey starts with a call to your local council.

Starting with a Council Needs Assessment

Before anyone even starts talking about money, the first step is to get a clear picture of the care that’s actually needed. You can request a free needs assessment from your local council’s adult social services department for the person who needs support.

This assessment has nothing to do with finances. It's purely focused on understanding their day-to-day challenges, their health, and what support they need to live safely and with dignity in their own home.

If the assessment shows they are eligible for support from the council, then you move on to the financial side of things.

The Financial Assessment (or Means Test)

Once the needs assessment confirms that support is required, the council will carry out a financial assessment. You'll often hear this called a means test. This is where they take a look at the person’s income, savings, and other assets to figure out how much they should contribute towards their own care costs.

There are very specific financial thresholds, and it's worth knowing that these can change each year.

- Upper Capital Limit: If someone has savings and assets above this level (currently £23,250 in England), they will usually be expected to pay for their own care in full. This is often referred to as being a 'self-funder'.

- Lower Capital Limit: For those with capital below this threshold (currently £14,250), their contribution will be worked out based on their income, but their savings won't be touched.

- Between the Limits: If their assets fall between these two figures, they will need to contribute from their income, plus a calculated amount based on their capital, known as a 'tariff income'.

Getting your head around the outcome of this means test is absolutely crucial. It gives you a clear, black-and-white picture of what the council will pay for and what portion, if any, you'll need to cover yourselves.

Other Important Funding Avenues

Council funding is the most common route, but it's certainly not the only one. Depending on someone’s specific health needs, there are other significant sources of financial help that can make a huge difference.

One of the most important is NHS Continuing Healthcare (CHC). This isn't council funding; it's a package of care arranged and paid for entirely by the NHS. It’s for people who have a "primary health need," which basically means their care needs are mostly due to complex medical conditions. Crucially, CHC funding is not means-tested and covers the full cost of care.

Another key benefit to look into is Attendance Allowance. This is a tax-free payment for people who are over State Pension age and need a bit of help with personal care or supervision because of an illness or disability. It’s also not means-tested, and that extra money can really help offset the day-to-day costs of having a carer.

The Hard Truth About Council-Funded Homecare

Council funding can be a huge help for families needing support, but it's important to be realistic about the state-funded care system. The simple fact is there’s often a massive gap between what local councils can afford to pay and what it actually costs to provide safe, high-quality care.

This shortfall puts care providers in a tough spot. They're trying to deliver the best possible support, but the financial reality of low council fee rates makes it a real struggle. When the funding doesn't cover the true costs, it's hard to pay carers a fair wage that reflects their incredible skill and dedication. This can lead to a high turnover of staff, which in turn affects the consistency of care your loved one receives.

Understanding the Funding Gap

So, where does this problem come from? At its heart, the issue is that the hourly rates paid by most local councils are miles away from the industry-recognised benchmarks for sustainable, quality care. This underfunding puts immense pressure on providers who are just trying to cover the basics—wages, training, insurance, and even the time carers spend travelling between homes.

The latest figures really highlight the scale of the problem. For 2025-26, the average fee councils paid was just £24.10 per hour. That sounds like a lot, but it's nowhere near the Homecare Association’s recommended Minimum Price of £32.14 per hour. This minimum isn't an aspirational figure; it's what's calculated as necessary for providers to meet all their legal and quality obligations. You can dig into the full analysis and see the realities of state-funded homecare rates for yourself.

This gap between council funding and the true cost of care isn't just a number on a spreadsheet. It's a deep-rooted issue that threatens the stability of the entire care sector and, most importantly, the well-being of the people who depend on it.

What This Means for Your Family

Knowing about this funding reality is crucial when you're planning how to pay for care, particularly if you’re counting on council support. It helps set realistic expectations about what can realistically be delivered within a tight, council-funded budget.

Because of this shortfall, many families discover they need to find a way to supplement the council's contribution. This is where a 'top-up fee' often comes into the picture. A top-up is simply an extra payment you make directly to the care provider to bridge that financial gap between the council’s rate and the provider’s private charges.

This additional amount can make all the difference, helping to secure:

- A more consistent and familiar team of carers

- Greater flexibility with the timing of visits

- Access to more experienced or specially trained staff

By choosing to pay a top-up, you can ensure your loved one gets the personalised, reliable support they truly deserve. It gives providers like us in Stoke-on-Trent and Newcastle-under-Lyme the financial breathing room to maintain the high standards your family rightly expects.

Practical Ways to Manage and Reduce Your Care Costs

Seeing the numbers is one thing, but getting a firm grip on your budget is what really makes a difference. The good news is there are several smart ways to manage the costs of in-home care, making sure every penny is well spent without ever compromising on the quality of support.

Your most powerful tool, by far, is a detailed care plan. When you work closely with a provider to map out precisely what support is needed—and just as importantly, what isn't—you stop paying for unnecessary services. This focused approach means the care is efficient and cost-effective right from the start. You can see exactly how this is done in our guide to arranging home care services in 5 simple steps, which walks you through the entire planning process.

Agency Carers vs Private Hires

One of the biggest financial decisions you'll face is whether to go through a regulated agency or hire a private carer directly. At first glance, a private arrangement might look like the cheaper option, but it’s vital to understand the hidden responsibilities that come with it. When you hire privately, you become the employer, which means you’re legally on the hook for everything from insurance and payroll to finding cover when they're off sick or on holiday.

A regulated agency, on the other hand, takes care of all that for you. That slightly higher hourly rate actually covers a lot of ground:

- Comprehensive Insurance: This protects both you and the carer from any mishaps.

- Managed Payroll: You won't have to navigate the complexities of tax or National Insurance.

- Guaranteed Cover: If your regular carer is unavailable, the agency sorts out a suitable replacement.

- Vetting and Training: All carers are thoroughly checked (including DBS) and properly trained.

Choosing an agency provides a safety net and priceless peace of mind. It absorbs all the risk and admin, letting you focus completely on your loved one’s well-being.

Tapping into All Available Support

Finally, it’s absolutely essential to explore every bit of financial help available. This starts with claiming all the state benefits you're entitled to. For example, Attendance Allowance is not means-tested and can provide a significant boost to your care budget.

Don't stop there, though. Look into local charitable support. Many organisations offer grants or practical assistance for older people or individuals with specific health conditions. A bit of digging into charities here in Stoke-on-Trent and Newcastle-under-Lyme can unearth some fantastic resources, helping to make your budget go that much further.

Your Questions About Home Care Costs, Answered

Working out the finances for care can feel like a maze. To help you find your way, we've put together answers to the questions we hear most often from families across Stoke-on-Trent and Newcastle-under-Lyme.

Is Live-in Care Cheaper Than a Care Home?

It’s a question that comes up a lot, and the answer often surprises people. Yes, for a couple, live-in care can absolutely work out to be the more affordable choice.

Think about it this way: a care home bills on a per-person basis. That means a couple faces two sets of fees, which can escalate the monthly cost dramatically. A live-in carer, on the other hand, is there for the household. While their rate will naturally be higher to care for two people instead of one, it's nearly always less than the cost of two beds in a residential home. This makes it an incredibly effective way to keep couples together, right where they want to be.

Will I Have to Sell My Home to Pay for Care?

This is probably one of the biggest fears we hear, but when it comes to care in your own home, the answer is simple: no.

When the council carries out a financial assessment for home-based care (whether it's visiting or live-in), the value of your main home is not counted. It's completely off the table. Your property only becomes a factor if you're moving into a care home permanently.

Your home is not included in the means test for in-home care. This rule is specifically in place to support people to remain in their own homes for as long as possible.

What’s Not Included in the Hourly Rate?

Knowing what isn't covered is just as important for budgeting as knowing what is. The hourly rate pays for the carer's dedicated time and professional support, but there are a few other things you'll need to account for.

- Carer Mileage: If you ask your carer to use their own car for errands, appointments, or taking your loved one out, there will usually be a standard charge per mile to cover fuel and running costs.

- Activity Costs: Things like tickets to a local museum, a trip to the cinema, or even just a coffee and slice of cake at a favourite café will need to be paid for separately.

- Household Shopping: Your carer can absolutely handle the weekly shop, but the money for the groceries themselves will come from a household budget you set up.

Figuring out the best path forward for care can feel overwhelming, but you're not on your own. At Cream Home Care, we believe in giving clear, straightforward advice to help you make sense of it all. Get in touch today for a friendly, no-obligation chat about your family's needs.