When you start looking into live-in care, one of the first questions you'll have is, "How much does it actually cost?" The short answer is that in the UK, you can expect to pay anywhere from £1,200 to over £2,000 a week.

You might find lower rates if you hire a self-employed carer directly, while a fully managed agency service will naturally sit at the higher end of that scale.

Understanding the True Cost of Live-In Care

Choosing live-in care is a big decision, both emotionally and financially. Getting to grips with the real costs involved takes a bit of foresight, much like planning for any other major life event. That's why it's so important to think about When to Plan Ahead for Care Costs.

The price you first see quoted is almost always just the starting point. Think of it like booking a holiday – the base price covers the flight and a basic room, but the final bill depends on whether you upgrade to a suite, book excursions, or need special assistance.

It’s the same with live-in care. The cost isn't a single, one-size-fits-all figure. It’s a flexible amount that directly reflects the unique needs of the person being cared for.

What Shapes the Final Price Tag

So, what are these variables that determine the final weekly fee? There are a few key factors that really drive the cost, and we'll break them down throughout this guide.

- Complexity of Care Needs: This is the biggest one. Basic companionship and a helping hand with daily chores will cost significantly less than specialised care for conditions like advanced dementia, Parkinson's, or post-stroke recovery.

- Hiring Route: Your choice between using a fully managed agency or directly hiring a self-employed carer will make a big difference to the overall cost and the level of support you receive.

- Location: While it’s not as dramatic a factor as in, say, the property market, where you live in the UK can cause slight variations in carer costs.

The initial cost of live-in care provides a baseline, but the final expense is a personalised figure reflecting individual circumstances, required skills, and the level of support provided.

To give you a clearer picture, here's a quick look at how those costs can stack up.

Estimated Weekly Live-In Carer Costs At a Glance

This table provides a summary of typical weekly costs for different live-in care arrangements, helping you quickly compare the main options.

| Care Arrangement | Typical Weekly Cost (£) | Key Considerations |

|---|---|---|

| Basic Companionship & Support | £1,200 – £1,500 | For individuals needing general help with housekeeping, meal prep, and social interaction. No complex medical needs. |

| Intermediate Care Needs | £1,500 – £1,800 | For those requiring more hands-on personal care, mobility support, and management of conditions like early-stage dementia. |

| Complex or Specialist Care | £1,800 – £2,000+ | For individuals with advanced conditions, challenging behaviours, or those requiring specialist skills (e.g., PEG feeding, stoma care). |

| Couple Care | £1,600 – £2,200+ | A cost-effective option for two people living together, though the final price depends on the combined needs of the couple. |

Understanding these variables is the key to budgeting effectively and making a decision that truly works for your family's needs and finances. This guide is here to give you that clear, realistic picture.

For a wider view of the different ways you can get support at home, you might also find our ultimate guide to care at home services helpful.

Key Factors That Influence Your Final Cost

Trying to pin down the cost of a live-in carer isn't like looking up a price in a catalogue. It’s far more personal than that. Think of it as a bespoke service, where the final figure is tailored to fit a unique set of circumstances. Much like a basic car insurance policy is worlds apart from a fully comprehensive one, the cost of care directly reflects your specific needs.

The biggest driver of the final price is, without a doubt, the level and complexity of care required. Someone who needs a bit of companionship and a hand with light housekeeping will naturally have a lower weekly cost. This is very different from the support needed for an individual with advanced dementia, Parkinson’s, or significant mobility challenges.

Specialist skills, like managing a stoma or PEG feeding, require advanced training and experience, and the fee will reflect that expertise.

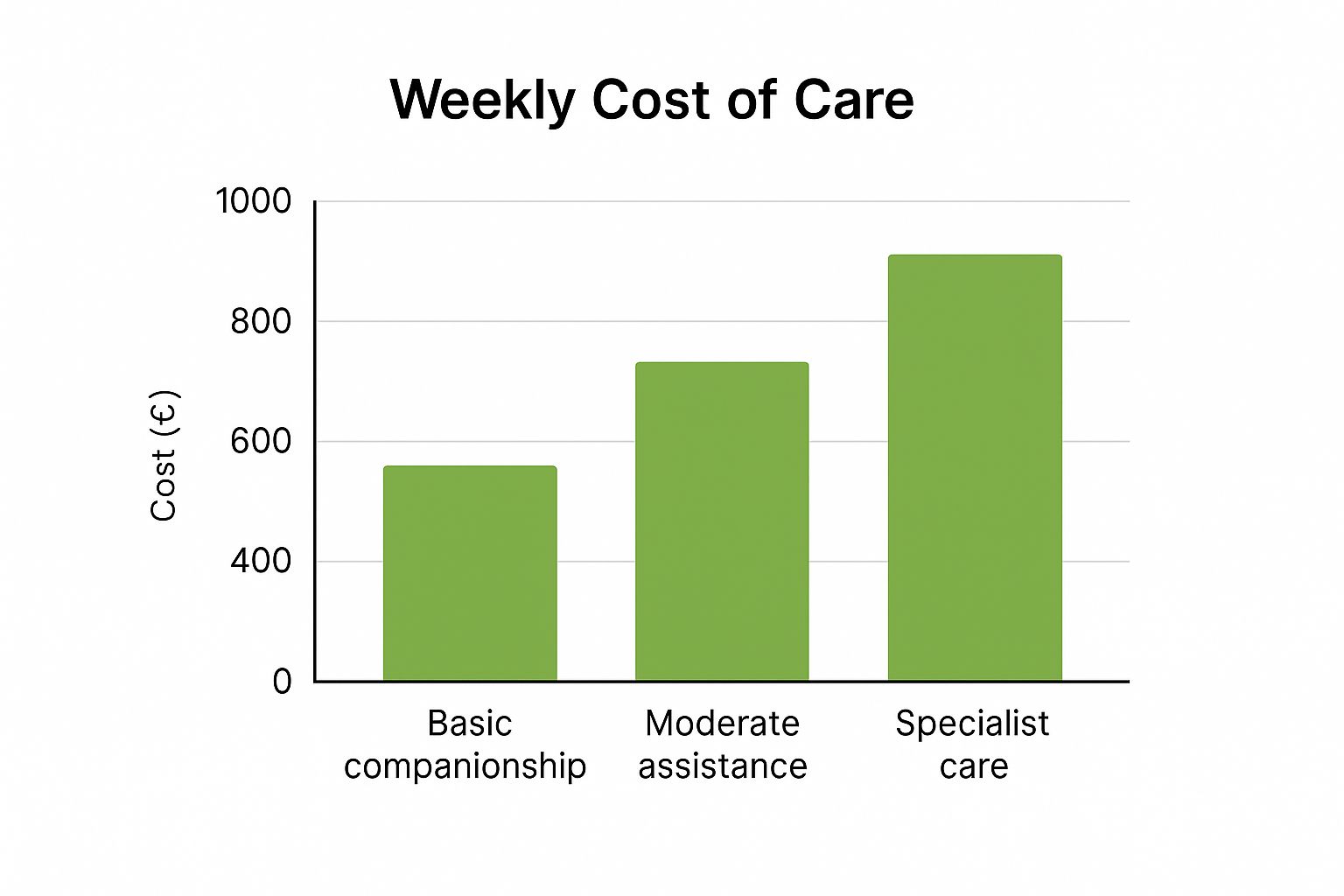

This infographic breaks down how weekly costs can shift depending on the level of support needed.

As you can see, the jump from basic support to complex, specialist care is quite significant. It’s a perfect illustration of why a thorough, honest care assessment is the essential first step.

Carer Experience and Qualifications

A carer’s professional background and qualifications are also a major factor in what they charge. It only makes sense that a highly experienced carer with years of dedicated service and specialist certifications will command a higher rate than someone just starting their career.

Thankfully, this career path is becoming much more formalised. In the last ten years, salaries for live-in carers in the UK have become better structured, with top-tier agencies now offering up to £1,001 per week for their most experienced staff. This system ensures that as carers build their skills and undergo further training, their pay rightly reflects their increased value and expertise.

It’s also important to understand the different kinds of support. Helping with daily chores isn’t the same as providing hands-on medical assistance. If you're unsure about the terminology, our guide explaining the key differences between personal care vs home help can clear things up.

The cost of live-in care isn't just a fee for someone's time. It's an investment in a specific skill set, a depth of experience, and the intensity of support needed to maintain a high quality of life.

Individual vs Couple Care

Another vital point to consider is whether the care is for one person or a couple. While arranging care for two people will, of course, cost more than for an individual, it’s almost always a more affordable route than paying for two separate places in a care home.

- Individual Care: The baseline cost is set entirely by one person's unique health and support needs.

- Couple Care: The fee is adjusted to account for the combined needs of both people. For instance, if one person has complex needs while their partner is fairly independent, the rate will be set accordingly. It provides incredible value, allowing a couple to stay together in the comfort of their own home.

By getting to grips with these core factors, you can start to build a much clearer picture of what the cost of a live-in carer might look like for your situation. This allows you to budget accurately and plan for the future with real confidence.

Agency Carers vs Self-Employed: A Cost Breakdown

When you’re looking into live-in care, one of the first big decisions you'll face is how to hire your carer. This choice really boils down to two paths: using a fully managed care agency or hiring a self-employed carer directly. Each option has its own pros and cons, especially when it comes to the overall cost and the amount of work you'll need to put in yourself.

Think of it like getting your house decorated. You could hire an interior design firm that handles everything—from finding the painters and sourcing the materials to managing the whole project. That’s the agency route. It’s a complete package, but you’re paying for that project management and peace of mind.

On the other hand, you could source and hire the painters, plasterers, and electricians yourself. This is the self-employed route. You might save money on management fees, but you suddenly become the project manager, with all the responsibility that entails.

To make things clearer, let's compare the two routes side-by-side.

Agency vs Self-Employed Live-In Carer Comparison

This table breaks down the key differences to help you see which option might be a better fit for your family's needs.

| Feature | Agency-Managed Carer | Self-Employed Carer |

|---|---|---|

| Weekly Cost | Generally higher, as it includes agency fees for management, vetting, and support. | Often lower on paper, as you pay the carer directly without an intermediary. |

| Vetting & Safety | Handled by the agency. This includes comprehensive background checks (DBS), reference verification, and qualification checks. | Your responsibility. You must conduct all checks yourself or hire a service to do so. |

| Admin & Payroll | All sorted. The agency takes care of contracts, National Insurance, tax, and pension contributions. | Your responsibility. You become the employer and must manage contracts, insurance, and legal duties. |

| Sickness & Holiday Cover | Seamless. The agency provides a vetted and trained replacement carer to ensure no gap in care. | Your responsibility. You must find, vet, and arrange suitable cover for any time off. |

| Training & Development | Ongoing. Carers receive regular training to keep their skills up-to-date with best practices. | Not guaranteed. You would need to check a carer’s training history and they manage their own development. |

| Support System | You have a dedicated care manager and a 24/7 support line for any issues or emergencies. | It's just you and the carer. Resolving disputes or issues falls entirely on you. |

As you can see, the "cheaper" route isn't always the simplest. It really comes down to how much time and energy you can commit to managing the care arrangement yourself.

The Agency Route: Peace of Mind Included

When you partner with a care agency, you’re buying much more than just a person's time. A big slice of that weekly fee goes towards the agency's wraparound support and management, which for many families is worth its weight in gold.

This all-in-one service typically covers:

- Rigorous Vetting: Agencies don't cut corners. They run thorough DBS checks and follow up on every reference and qualification.

- Ongoing Training: Good agencies ensure their carers get continuous professional development, so their skills are always sharp and in line with the latest care standards.

- Holiday and Sickness Cover: If your main carer gets ill or needs a well-deserved break, the agency sorts out a fully vetted replacement. You don't have to lift a finger.

- Payroll and Administration: All the boring-but-essential stuff like employment contracts, National Insurance, and pension schemes are handled by the agency.

This comprehensive approach takes all the stress out of the process, making it a dependable choice for families who need a solution they don't have to micromanage.

The Self-Employed Route: Greater Control and Responsibility

Hiring a self-employed carer can look like a more affordable option at first glance because you aren’t paying those agency management fees. This direct relationship can also offer more flexibility in agreeing on rates and working hours. It's a popular route for carers, too; recent data shows self-employed live-in carers in the UK can earn an average salary of £51,390 by setting their own rates. You can find more details on this over at Jooble's UK salary analysis.

However, taking this path effectively turns you into an employer, and that comes with some serious legal and practical duties.

Choosing a self-employed carer means you take on the full responsibility for vetting, contracts, insurance, and arranging your own backup cover for holidays or illness. The lower direct cost must be weighed against these added tasks.

Before you jump in, you need to be ready to:

- Conduct Your Own Vetting: You are personally responsible for all background checks to make sure the carer is trustworthy and properly qualified.

- Manage Employment Contracts: You'll have to create a legally sound contract that protects both you and the carer.

- Arrange Insurance: Getting the right employer’s liability insurance in place is absolutely crucial.

- Find Backup Cover: If your carer needs time off for any reason, the job of finding a suitable temporary replacement is all on you.

Ultimately, the best choice depends entirely on your family. Do you have the time and confidence to manage all these responsibilities, or would you prefer the security of a fully supported, managed service?

Budgeting For Hidden and Additional Expenses

When you’re working out the cost of a live in carer, it’s easy to focus on the main weekly fee. But that’s only part of the story. The carer’s salary is definitely the biggest slice of the pie, but several other costs, usually covered by the family, can creep in. Factoring these in from day one helps you avoid any nasty surprises later on.

Think of it like buying a car. The sticker price gets you the vehicle, sure, but you still need to pay for petrol, insurance, and MOTs to keep it on the road. Live-in care works in much the same way; there are a handful of standard, ongoing costs you need to plan for.

Common Household Contributions

Because your carer is living in the home, it's standard practice for you to cover their food and make a contribution towards the household bills. It makes sense, as these are everyday living expenses they’ll have while providing that dedicated, round-the-clock support.

- Food and Groceries: You’ll need to set aside a budget for the carer's meals. A typical weekly food allowance lands somewhere between £35 and £50. You can either give this as cash or simply add their preferred foods to the weekly family shop.

- Utility Bills: It's also expected that you'll cover the increase in utilities like gas, electricity, and water. While the carer won't be paying the bills themselves, having an extra person in the house will naturally push your usage up a bit.

Factoring in Travel and Transport Costs

Another area to think about is transport. How will your carer get to appointments, run errands, or travel to and from your home? These costs are a normal and necessary part of the arrangement.

If the carer uses their own car for work-related jobs, like picking up prescriptions or driving your loved one to a doctor's visit, you’ll need to reimburse their mileage. The standard accepted rate is 45p per mile, which helps cover their fuel and general running costs.

On top of that, many carers or agencies will ask for their travel costs to your home at the start of a placement and for their journey home at the end to be covered. It's really important to get this clarified and agreed upon in the contract from the outset. To get a better handle on planning for these kinds of expenses, you might find resources like these guides for estimating home repair costs useful for understanding the principles of cost estimation.

A good rule of thumb is to set aside an extra 10-15% of the weekly fee to cover these variable costs like food, mileage, and travel. That way, you’ll have a much more complete and realistic financial plan.

Planning for Carer Breaks and Equipment

Live-in carers work incredibly hard and, by law, they need regular breaks to rest and avoid burnout. When your main carer takes their well-deserved time off, you'll need to arrange for someone else to step in.

This is where respite care is invaluable, providing temporary cover to ensure there are no gaps in support. You can read more about how respite care supports families in our detailed guide. The key takeaway is that the cost for this cover needs to be a line item in your long-term budget.

Finally, have a think about whether any specialist equipment is needed. This could be anything from mobility aids and hoists to a hospital-style bed. While you may be able to get some items through the NHS, there's a chance you'll need to buy or hire others privately.

Finding Your Way Through Funding and Financial Support

Seeing the total cost of a live in carer is one thing; figuring out how to actually pay for it is another challenge entirely. The figures can feel a bit daunting at first, but it’s crucial to remember that you often don't have to shoulder the entire burden alone. There’s a whole system of financial support available across the UK, but unlocking it starts with one simple action.

Everything kicks off when you request a needs assessment from your local council. This isn't just a bit of bureaucratic box-ticking—it's the official gateway to nearly all forms of financial help. The assessment is essentially a thorough conversation with a social care expert to get a clear picture of your loved one's specific needs, their daily struggles, and what it will take to keep them safe and well in their own home.

The Needs Assessment: Your First Port of Call

You can think of the needs assessment as the first draft of a care plan. It's a completely free service, and everyone is entitled to one, no matter what their income or savings look like. During the assessment, a professional will look at everything from mobility and personal care to mental wellbeing. The result is an official record of the support needed, which is then used to determine if you’re eligible for funding.

If the assessment confirms that care is needed, the council will then carry out a financial assessment, often called a means test. This is where they look at income, savings, and other assets to figure out how much, if anything, you’ll be expected to contribute towards the care costs.

What Kind of Financial Support is Out There?

Once the assessments are done and dusted, a few different funding routes might become available. Each one has its own rules and eligibility criteria, so it pays to know what they are.

-

NHS Continuing Healthcare (CHC): This is the most comprehensive support package, arranged and paid for entirely by the NHS. It’s for people who have what’s known as a "primary health need," meaning their care is needed because of complex, intense, or unpredictable health conditions. The best part? CHC funding isn't means-tested, so it covers the full cost of a live-in carer, regardless of your finances.

-

Local Authority Funding: If you don't qualify for CHC but the needs assessment shows you need support, your local council might step in to help cover the costs. This support is means-tested. In England, for example, if your assets are below the £23,250 threshold, the council will contribute, though the exact amount will depend on your personal financial situation.

-

Attendance Allowance: This is a fantastic, tax-free benefit for anyone over State Pension age who needs a hand with personal care or requires supervision because of a disability or illness. It's not means-tested at all, so your savings and income don't matter. The higher rate is currently worth over £100 per week—a significant contribution that can make a real difference to your weekly live-in care budget.

The funding landscape can seem like a maze, but just remember that the path always starts in the same place: a call to your local council for a needs assessment. That single step is what can unlock the support you're entitled to.

By taking a structured approach and exploring each of these avenues, many families discover that the seemingly high cost of a live in carer becomes much more manageable. It's all about knowing where to turn and having the confidence to take that first step.

Your Live-In Care Cost Questions Answered

Once you’ve got a handle on the main costs, the practical, day-to-day questions start to bubble up. Thinking through how it will all work in practice is the final piece of the puzzle, and it’s what gives you the confidence to move forward.

Let’s walk through some of the most common questions we hear from families as they finalise their plans for live-in care.

How Often Do I Pay the Carer?

Payment schedules can differ a little depending on the provider, but you'll almost always be invoiced weekly or fortnightly. If you go through a care agency, they take care of all the admin, like the carer’s tax and National Insurance. You just get one straightforward invoice from the agency.

Hiring a self-employed carer is a bit different. You'll agree on payment terms directly with them – usually weekly – and it's up to you to make sure those payments are made on time according to your contract.

What Happens When My Carer Needs a Break?

This is a really important one. Live-in carers work incredibly hard and, just like anyone else, they need and are legally entitled to proper breaks. A typical pattern is for a carer to work a block of several weeks, say four to six, and then take a full week off to recharge.

It's absolutely crucial to have a solid plan for who will cover your carer's time off. This is where a managed agency service really shows its worth, ensuring there's always safe, continuous support in place.

An agency will have a fully-vetted and trained respite carer ready to step in without any fuss. If you’ve hired your carer directly, you'll need to sort out this cover yourself.

What About Unpaid Carers?

While this guide is all about the professional cost of a live in carer, we can't ignore the incredible contribution of unpaid carers. The reality is that family and friends provide the vast majority of care in the UK. The 2021 Census revealed there are a massive 5.8 million unpaid carers across the country. Even more striking, 1.7 million of them provide 50 or more hours of care every single week. It's a testament to the dedication found in families everywhere. You can see the full picture from the key facts and figures provided by Carers UK.

Do I Need to Update My Home Insurance?

Yes, absolutely. This is a small but vital detail you can't afford to miss. As soon as you have someone living and working in your home, you must let your home insurance company know.

They’ll almost certainly require you to add employer’s liability insurance to your policy. This is a legal must-have, and it protects you financially if your carer were to have an accident while working in your home. It doesn't matter if you use an agency or hire directly – this is non-negotiable.

At Cream Home Care, we believe in giving clear, honest, and compassionate advice to help you make the best choice for your family. If you have any more questions about arranging care in Stoke-on-Trent or Newcastle-under-Lyme, our friendly team is always here to chat. You can explore our personalised care services at https://creamhomecare.co.uk.